Earlier this month, Atlas founder Nick Nigro and I released an updated look at what it costs to own today’s best-selling cars and trucks. In a new fact sheet, we compared the total cost of ownership (TCO) for five of the most popular gasoline vehicles sold in the United States in 2024 and their closest electric vehicle (EV) counterparts. This analysis was finalized before Congress ended the federal EV tax credit, more on that below.

Using the Fleet Procurement Analysis Tool (FPAT), our analysis found that four of the five EVs beat comparable gasoline vehicles on total cost savings over seven years:

-

Nissan Leaf vs. Toyota Corolla – 5 percent cheaper

-

Hyundai Ioniq 6 vs. Toyota Camry – 7 percent cheaper

-

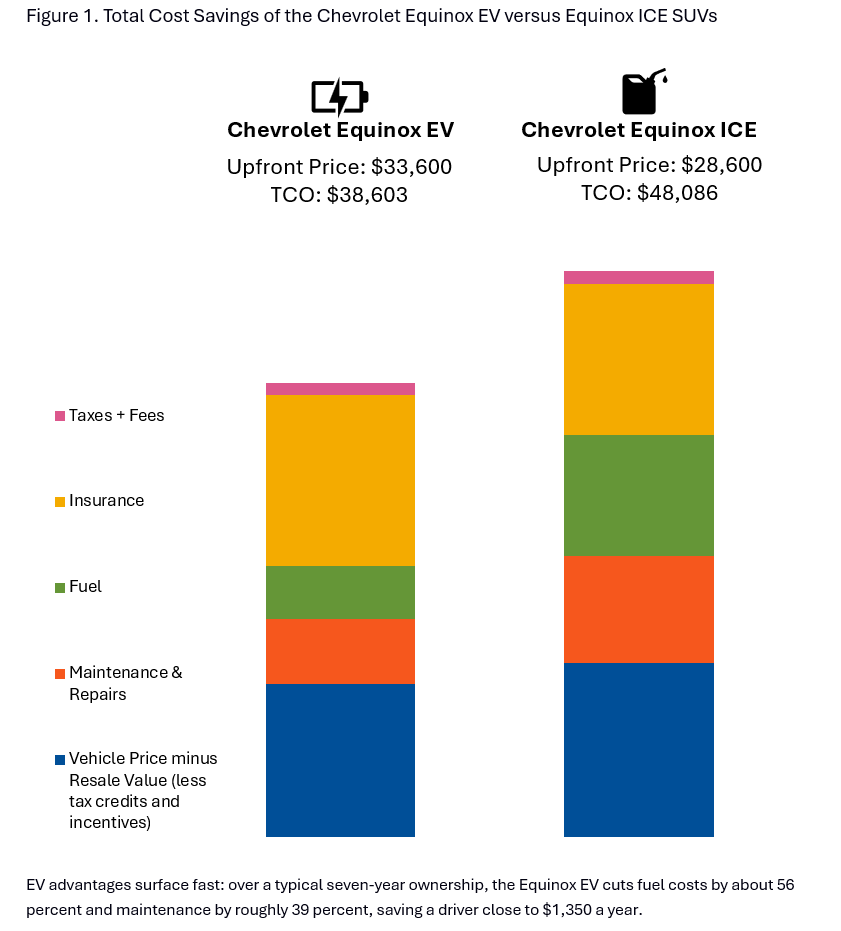

Chevrolet Equinox EV vs. Gas Equinox – 20 percent cheaper

-

Tesla Model Y vs. Jeep Grand Cherokee – 15 percent cheaper

-

Ford F-150 Lightning vs. Gas F-150 – 4 percent higher

The results reinforce what we found in our 2023 and 2022 analyses: while EVs may cost more up front, fuel and maintenance savings often overcome those higher costs resulting in a vehicle that’s cheaper to own. Lower electricity prices and fewer moving parts reduce daily operating costs to about half that of gasoline cars. Drivers who log above the national average of miles traveled or live in a state with higher gas prices stand to see their savings climb even higher.

|

|

|